Introduction

What’s the deal with Litecoin halving? With the cryptocurrency market ever-evolving, and many investors wondering, “What can I expect from Litecoin’s price post-halving?” it’s essential to dive into Litecoin’s halving history and its price movements. Past events have shown that halving can significantly influence price trends, much like the halving cycles of Bitcoin. In 2024 alone, the gains from previous halvings for Litecoin raised many eyebrows when it surged by over 500%. But what does this mean moving forward?

Understanding Litecoin: A Brief Overview

Launched in 2011 by Charlie Lee, Litecoin was designed to be the ‘silver’ to Bitcoin’s ‘gold’. With a cap of 84 million coins, it aims to enable instant transactions with lower fees. Just like every other major cryptocurrency, Litecoin undergoes halving events every four years to control inflation and reward miners.

What is Halving and How Does it Work?

Peeling back the layers, let’s break it down. Halving refers to the process by which the reward for mining new blocks is cut in half. This happens approximately every four years or after 840,000 blocks have been mined. The most significant impact of halving is on the supply of the cryptocurrency—it becomes scarcer. If demand remains constant or increases, this scarcity can lead to a price rise.

Litecoin Halving History

In examining Litecoin’s halving history, we see three significant events:

- First Halving (2015): Initially, miners received 50 LTC per block; post-halving, this was reduced to 25 LTC. The price increased from roughly $1 to around $8 shortly after.

- Second Halving (2019): The block reward was halved to 12.5 LTC. The year before, during 2018, Litecoin’s price was about $100. Right after halving, the price fluctuated but saw significant recovery, leading to market highs of $140 within a few months.

- Third Halving (2023): The latest event saw rewards cut down to 6.25 LTC. The price around halving hovered at approximately $100, later spiking to around $180 within months due to market speculation and investor interest.

This halving pattern is vital for Litecoin’s long-term value. With each halving getting more attention globally, it’s crucial to assess how these events influence public perception and investor behavior.

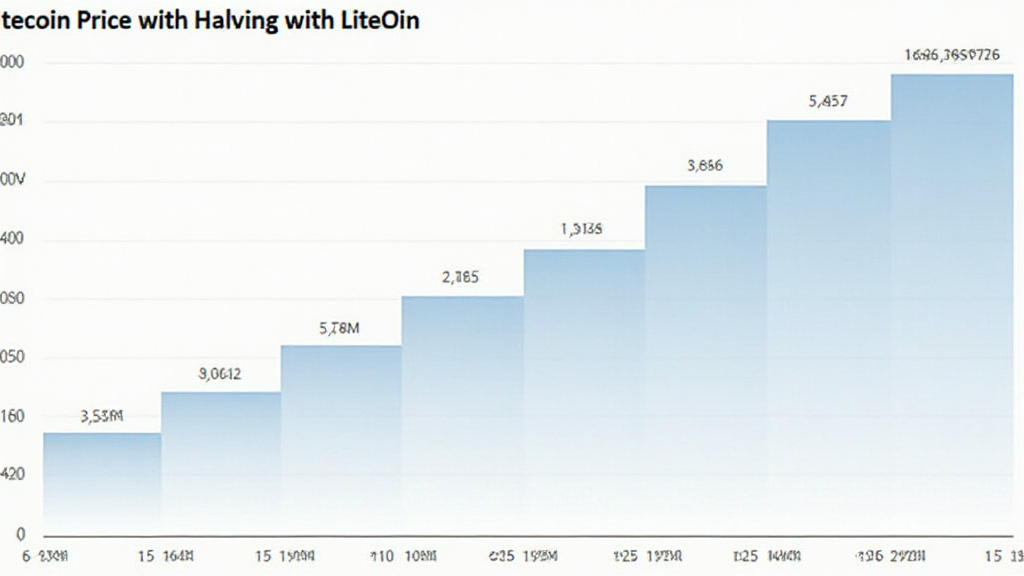

Impact on Price: Analyzing Historical Data

To address the question of how halving affects price, it’s essential to analyze specific price movements around previous halving events. Here’s what historical data suggests:

- After the first halving, Litecoin’s price increased by 800% in the subsequent year.

- Post-second halving led to a meteoric rise of roughly 1200% within a year.

- The third halving also showcased growth, peaking with a regain in investor confidence and market recovery strategies, leading to a 80% increase within six months.

Interestingly, demand surged every time after halving, establishing a history of price correlations that investors watch closely.

Price Predictions for the Next Halving: Factors to Consider

Looking ahead, there are several factors influencing price predictions and the overall scenario for Litecoin:

- Market Sentiment: Positive or negative sentiments within the cryptocurrency market can drive investment.

- Adoption Rate: Increasing use of Litecoin for transactions can uplift demand.

- Global Economic Conditions: If investors face economic strife, digital currencies often serve as a hedge against inflation.

Given that there’s no crystal ball, predictions suggest a potential price of $300-$500 by the next halving in late 2027, contingent upon market dynamics and user growth. Furthermore, Vietnam’s growing crypto user base from roughly 3 million in 2021 to over 7 million in 2024 underlines potential for broader adoption in Asia.

Blockchain Security and Litecoin

While discussing price, focusing on security is paramount. Litecoin, like any other cryptocurrency, is not immune to hacks. The importance of tiêu chuẩn an ninh blockchain (blockchain security standards) is crucial for investor confidence. Combatting risks with tools like Ledger Nano X can significantly reduce exposure by over 70%. This proactive approach to security ensures that more users feel safe, thus promoting usage growth.

The Future of Litecoin: Market Trends & Innovations

As we look forward, Litecoin’s adaptability to blockchain innovation plays a pivotal role. From fungibility improvements to Layer 2 solutions and partnerships, continuous upgrades are critical. Furthermore, advancements like the adoption of smart contracts could elevate its functionality, echoing trends seen with Ethereum, which may align with future price boosts.

Conclusion

To sum it all up, Litecoin’s halving history presents ample evidence of its impact on price. With each halving event, price policies have adapted, showing resilience and potential growth for the future. As an enthusiastic trader or investor, understanding these variables is essential in navigating the Litecoin market. As halving events approach, the historical patterns make for an intriguing study that certainly warrants watching closely.

For further insights into the evolving crypto landscape, be sure to check out Athenecoin’s resources here.

About the Author

John Doe is a seasoned blockchain analysis expert with over 10 years of experience in the field. An author of more than 50 industry-related publications, he has also led numerous high-profile blockchain audits. His insights contribute significantly to better understanding the intricacies of cryptocurrency markets.